POWER BEHIND THE THRONE: Crown Prince Mohammed bin Salman wants to build a modern, dynamic Saudi economy. Yet the changing fortunes of families like the Bin Ladens have cemented the role of the state.

***

The Bin Ladens once ranked among Saudi Arabia’s most powerful business families. They built palaces, mosques and cities on the orders of successive kings. But that changed as Prince Mohammed bin Salman grew in influence. This is the story of the Bin Ladens’ fall.

***

JEDDAH/RIYADH – Soon after Prince Mohammed bin Salman became second in line to the throne of Saudi Arabia, he turned his sights to the sprawling empire of the Saudi Binladin Group.

In 2015, the prince, then 29, approached Bakr bin Laden, chairman of the family-owned construction giant, and told him he wanted to become a partner in the firm, according to six people briefed on the exchange.

The prince pitched his offer as a patriotic opportunity to help transform the kingdom’s oil-dependent economy. It would also, he said, ease the financial strain on the company as the government reined in infrastructure spending to cope with a drop in oil prices.

As head of the Saudi royal family’s favoured building contractor, Bakr bin Laden was accustomed to obliging royal requests. But he hesitated at the prince’s approach, these sources said. The construction mogul replied that he needed time to consult other family shareholders.

In the months that followed, Prince Mohammed bin Salman, known by many simply as MbS, grew more powerful, rising to crown prince in June 2017. He championed economic reform and took aim at widespread corruption.

The Bin Ladens, in contrast, experienced a dramatic fall from grace.

Three Bin Laden brothers, senior executives in the family firm, were among more than 200 businessmen, royals and officials detained in November 2017 in an anti-corruption drive ordered by the prince. Bakr and two of his brothers, Saleh and Saad, eventually transferred their combined 36.2 percent stake in the family firm to the state in April 2018. Bakr, in his late 60s, is still in custody, although no charges have been made public.

Reuters spoke to more than two dozen Saudi Binladin Group employees, family friends, government officials, bankers and businessmen to tell the story of the fall of the Bin Ladens. Few of the sources would go on the record, citing the Bin Ladens’ long-standing preference for privacy and restrictions on public criticism of the Saudi government. These sources charted the family’s reversal of fortune, starting with that 2015 exchange between Bakr and Prince Mohammed and ending with the state taking management control of the family firm.

The Bin Ladens’ undoing exposes the contradictions in Prince Mohammed’s plan to build a modern economy, some economists say. He has embraced privatisation, hoping to inject dynamism, yet the state has intervened in firms such as Saudi Binladin Group. He has tackled corruption, yet there has been little transparency around the process. One Saudi businessman said the Bin Laden saga had become a “symbol of what’s happening between the government and the private sector – a breakdown of trust.”

Asked to comment, a senior government official said Prince Mohammed did not seek a stake in Saudi Binladin Group in 2015. The Saudi government, he added, had saved the company from collapse after it experienced financial difficulties “coupled with extensive supervisory and governance weakness.” Saudi Binladin Group was “a vital Saudi commercial entity,” he said. The Bin Laden family and its representatives did not respond to a request for comment.

BEFORE THE FALL: Saudi Binladin Group Chairman Bakr Bin Laden (second from right) shows a government delegation around his firm’s Medina mosque expansion project in 2014. Bakr was among more than 200 businessmen, officials and royals detained in Nov. 2017 in a crackdown on corruption. Saudi Press Agency/Handout via REUTERS

BEFORE THE FALL: Saudi Binladin Group Chairman Bakr Bin Laden (second from right) shows a government delegation around his firm’s Medina mosque expansion project in 2014. Bakr was among more than 200 businessmen, officials and royals detained in Nov. 2017 in a crackdown on corruption. Saudi Press Agency/Handout via REUTERS

NEW KING, NEW RULES

The Bin Laden clan has known trouble before: The black sheep of the family, Osama, masterminded the attacks on America of Sept. 11, 2001. But the Bin Ladens, led by Bakr, survived that storm. Their reckoning began with King Abdullah’s death in January 2015.

Saudi Binladin Group had grown from humble beginnings in 1931, nourished by the Bin Laden family’s good relations with successive rulers. Royal contracts were arranged informally, sometimes scribbled on paper over coffee.

“It was the ‘inshallah bukra’ [God willing, tomorrow] way of doing business, with a meeting that might have been scheduled for 11 a.m. in the office, rescheduled to 4 p.m. and then actually taking place at 2 a.m. at the palace,” said Thomas Fallows, an American banker who worked in Riyadh for eight years.

In the last months of King Abdullah’s life, oil prices tumbled to $60 a barrel from above $100 at their peak, slashing the kingdom’s revenues. By the time 79-year-old King Salman acceded to the throne, projects commissioned in the boom years were becoming a burden. These included a Riyadh financial district, an airport in Jeddah and an economic city on the Red Sea coast.

Salman quickly appointed Prince Mohammed, a previously little-known son, as deputy crown prince. Mohammed also took control of the kingdom’s important economic and defence portfolios.

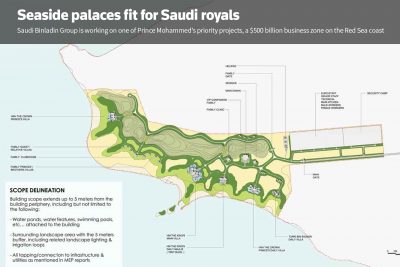

BY ROYAL ORDER: The Bin Ladens’ company, now under government management control, carries on. NEOM business zone on the Red Sea coast includes waterfront palaces. Above is the ground plan for this royal retreat.

BY ROYAL ORDER: The Bin Ladens’ company, now under government management control, carries on. NEOM business zone on the Red Sea coast includes waterfront palaces. Above is the ground plan for this royal retreat.

As a teenager, Prince Mohammed had regularly attended meetings with his father, Riyadh’s governor at the time, but left little impression, said a former senior Western diplomat. But Salman saw in the boy qualities he prized, according to Saudi and Western sources. “Clever, rugged, understands the locals,” said one Western policy adviser. Other princes went abroad, but Prince Mohammed stayed in Saudi Arabia, earning a law degree and investing in the Riyadh stock market. By the time Salman became king, the young prince was sitting in on meetings with foreign officials and silently communicating with his father via iPad, the former Western diplomat said.

Reform-minded and ambitious, Prince Mohammed was keen to challenge the status quo. He introduced changes to streamline government, diversify the economy and cut costs, including slashing construction spending. One of the new government’s first moves in 2015 was to order a review of state contracts, with a focus on the big projects on which Saudi Binladin Group depended, said two sources.

Asked about the results of this review, the senior government official said, “The government is keen to review all projects, including those contracts that may have a suspicion of corruption or negligence in their sites.”

Prince Mohammed encouraged Saudi Binladin Group to sell shares in an initial public offering, according to seven sources familiar with the discussions, part of efforts to develop the kingdom’s capital markets. The Bin Ladens had previously shelved IPO plans begun in 2011, worried that they would not get a good price in a stock market battered by low oil prices, and put off by the red tape involved in a share issue. The family was reluctant to revive the idea in 2015, when market conditions were worse, these seven sources said.

Asked to comment, the senior government official denied that Prince Mohammed had promoted the idea that Saudi Binladin Group should sell shares in an IPO.

Then, in September 2015, a construction crane owned by Saudi Binladin Group collapsed in Mecca’s Grand Mosque, killing 107 people just before the start of Islam’s annual haj pilgrimage. The government moved against the company, suspending it from receiving new state contracts and barring its board members and senior executives from traveling abroad. It also ordered the Finance Ministry to review the firm’s existing projects, citing unspecified “shortcomings.”

DISASTER: In Sept. 2015, a construction crane owned by Saudi Binladin Group collapsed in Mecca’s Grand Mosque, killing 107 people. The government suspended the company from receiving new state contracts and barred its board members and senior executives from traveling abroad. REUTERS/Mohamed Al Hwaity

DISASTER: In Sept. 2015, a construction crane owned by Saudi Binladin Group collapsed in Mecca’s Grand Mosque, killing 107 people. The government suspended the company from receiving new state contracts and barred its board members and senior executives from traveling abroad. REUTERS/Mohamed Al Hwaity

A senior Saudi Binladin Group executive and a source close to the family said the crane accident gave the government an opening to act against the firm. The executive said Saudi Binladin Group wasn’t responsible for the site at the time – the work fell under the supervision of local authorities in Mecca. The senior government official disputed this, saying it was standard practice that the contractor supervised the site. A legal case over the incident was still pending, he added.

The Bin Laden family “took the slap on the hand and accepted it,” the executive said. “They would never speak out against the king or the crown prince. They are loyal servants.”

The family tried to limit the damage. Bakr sent a letter to brother Saleh formally handing him responsibility for the company, hoping that a change of management would placate the government, according to two people who saw the letter. But the plan didn’t work. As payments from the state dried up, Saudi Binladin Group’s finances deteriorated and it stopped paying tens of thousands of its workers, leading to riots. By mid-2016, much of the group’s construction work was stalled, including at projects essential to Prince Mohammed’s reform plans.

Again the Bin Ladens tried to defuse the situation. Saudi Binladin Group hired dozens of finance and management professionals from overseas, including former Morgan Stanley banker Klaus Froehlich as chief financial officer. Froehlich, who remains CFO, came armed with years of experience in Saudi deal making. He also had ties to Mohammed al-Jadaan, who would soon be appointed finance minister, two sources said. Al-Jadaan did not respond to a request for comment.

TRUSTED BUILDER: Saudi Binladin Group expanded the Grand Mosque in Mecca and the Prophet’s Mosque in Medina, two of Islam’s holiest sites. Above, Muslims pray at the Grand Mosque before the Haj pilgrimage. REUTERS/Suhaib Salem

TRUSTED BUILDER: Saudi Binladin Group expanded the Grand Mosque in Mecca and the Prophet’s Mosque in Medina, two of Islam’s holiest sites. Above, Muslims pray at the Grand Mosque before the Haj pilgrimage. REUTERS/Suhaib Salem

Creditors who had been struggling to reach Saudi Binladin Group during its crisis said communication improved after Froehlich arrived. Government payments started coming through again. Financial pressure eased. The company also put plans for a public stock offering back on the table, bowing to state pressure to “recycle” some of the money it had made over the decades back into the kingdom, according to six people familiar with the plans. It appeared that relations between the Bin Ladens and the government were on the mend.

But the detente would not last long. Saudi Arabia was careening toward a recession, and market conditions for a listing were worsening. To the government’s irritation, the stock offering plans stalled again because of this deteriorating environment. “The rulers and MbS saw [the Bin Ladens] as a leech sucking the lifeblood out of Saudi Arabia but offering nothing in return,” said one person who had worked on the company’s restructuring. “They ran out of patience.”

In June 2017, Prince Mohammed replaced his cousin, security chief Prince Mohammed bin Nayef, as heir apparent, further centralising the levers of power. More than ever, Prince Mohammed was in a position to do something about the Bin Ladens.

DOWNFALL

On the night of Nov. 4, 2017, Saudi authorities detained Bakr bin Laden in Jeddah along with more than 200 other members of the Saudi elite, in what officials said was a crackdown on corruption. Dozens of Bin Laden family members, including the brothers’ children, had their bank accounts frozen and were banned from travelling abroad, said associates of the family. Brothers who were abroad at the time were recalled to the kingdom.

For Bakr, it was the beginning of a detention that has lasted more than 10 months. Like many others, he was first held at the Ritz-Carlton Hotel in Riyadh. So were his brothers Saleh and Saad, fellow major shareholders. Other Bin Laden brothers – Omar, Ahmed, Mohammed, Abdullah and Yehya among them – were brought to the hotel for shorter periods, according to four family associates.

CHANGING FORTUNES: The headquarters of the Saudi Binladin Group in Jeddah. On April 23, the government finalised the transfer of 36.2 percent of the company, according to a Commerce Ministry document. REUTERS/Katie Paul

CHANGING FORTUNES: The headquarters of the Saudi Binladin Group in Jeddah. On April 23, the government finalised the transfer of 36.2 percent of the company, according to a Commerce Ministry document. REUTERS/Katie Paul

“It was the ‘inshallah bukra’ [God willing, tomorrow] way of doing business.” Thomas Fallows, an American banker who used to work in Riyadh

The purge affected royals, ministers and business leaders. The Bin Laden family’s hometown of Jeddah, once the economic capital of Saudi Arabia, was particularly hard hit. Many of the city’s merchant families had maintained close relationships with previous kings; few of them were spared in the crackdown.

The government publicly has not said precisely why the Bin Ladens – or any of the other individuals caught up in the anti-corruption campaign – were detained. King Salman said at the time the purge was in response to “exploitation by some of the weak souls who have put their own interests above the public interest, in order to, illicitly, accrue money.”

Two sources said the Bin Laden brothers received little attention in the hotel and were left alone in their rooms watching TV and eating room service. One family associate said a younger brother told him he was never informed why he was there, had no access to a lawyer and was barely visited by interrogators. Like others in the Ritz, they were made to keep the doors to their rooms open and a doctor came to check on them regularly. Authorities also employed a notary to facilitate the changing of power of attorney on assets. One brother described it bluntly to a friend upon his release: “It was a shitty experience.”

Asked to comment, the senior government official referred Reuters to statements issued at the time by the kingdom’s Attorney General. These statements said suspects had “the same rights and treatment as any other Saudi citizen.”

“Everyone is presumed innocent until proven guilty, and everyone’s legal rights will be preserved,” Attorney General Sheikh Saud Al Mojeb said on Nov. 5, 2017.

HOTEL PRISON: Saudi authorities launched their corruption crackdown on the night of Nov. 4, 2017. Bakr bin Laden was initially held at Riyadh’s Ritz-Carlton hotel. REUTERS/Faisal Al Nasser

HOTEL PRISON: Saudi authorities launched their corruption crackdown on the night of Nov. 4, 2017. Bakr bin Laden was initially held at Riyadh’s Ritz-Carlton hotel. REUTERS/Faisal Al Nasser

The Ritz was cleared of prisoners in late January but Bakr is still in detention in Riyadh, able to receive visits only from his immediate family members, according to five people familiar with the situation. Asked about Bakr’s whereabouts and the status of the investigation, the senior government official referred Reuters to the Attorney General. The Attorney General did not respond to a request for comment.

The other brothers are at home in Jeddah, but keeping a low profile. Saleh, the most gregarious, has returned to playing card games with friends, said one acquaintance. Stripped of many of his assets, including a palace in Jeddah bestowed by King Abdullah, he has been visiting banks to ask for help, according to one lender. “He’s putting a brave face on,” the lender said.

Authorities seized the title deeds to the homes of senior brothers, including Bakr’s villa overlooking the Red Sea, as part of settlements for their release, four sources said. The state also took private jets, cash, jewelry and Saad’s $90 million automobile collection, which included limited edition Ferraris and other rare Italian cars, said two sources. Bakr’s son Nawaf was relieved of every Maserati in his personal showroom.

Asked to comment, the senior government official referred Reuters to the Attorney General’s Office. It did not respond. In a statement at the time of the Ritz detentions, Attorney General Saud Al Mojeb estimated that corruption and embezzlement had cost Saudi Arabia at least $100 billion over several decades. In Dec. 2017, he said most detainees faced with corruption allegations had agreed to a “settlement,” involving assets including real estate, cash and securities.

THE TAKEOVER

The core of the Bin Laden family’s settlement with the government involved the conglomerate itself.

On April 23, the government finalised the transfer of 36.2 percent of the company, representing the shares held by Bakr, Saleh and Saad, to an entity called Istidama Holding Company, according to a Commerce Ministry document reviewed by Reuters. Two people who have dealt with Istidama said it was set up by the Ministry of Finance to park the proceeds of settlements agreed between the government and individuals detained in the corruption purge. The senior government official confirmed to Reuters that the Ministry of Finance owns Istidama. There are no public filings about Istidama because it is not a listed firm, and Reuters was unable to contact the company.

The government established a five-man committee to oversee the running of Saudi Binladin Group. Its members include Abdulrehman al-Harkan, a former chief executive of Riyadh-based developer Dar Al Arkan; Khaled Nahas, a board member of petrochemical producer Saudi Basic Industries Corp; and Khalid al-Khowaiter, chief financial officer at Advanced Electronics Company, a state-established technology firm. These government appointees are considered by many close to the company to be a front for the rulers. “The bottom line is that the government has taken over,” said one banker in Jeddah.

Harkan, Nahas and Khowaiter did not respond to requests for comment. The senior government official said the supervisory committee was “an independent committee that represents the interests of all partners.”

The remaining two-thirds of Saudi Binladin Group are still held by 15 younger Bin Laden brothers, according to the Commerce Ministry document. Two family representatives were appointed to the oversight committee – Yehya, who ran the back office, and Abdullah, a Harvard-educated lawyer who handled the conglomerate’s interests in the United States. Several sources interpreted their inclusion as a token gesture by the government. The brothers and their representatives did not respond to requests for comment.

The void left by the family’s diminished role was filled by Harkan, the developer, who reports to the royal court and to Finance Minister Mohammed al-Jadaan, according to the group executive. As chairman of the committee and the effective head of Saudi Binladin Group, Harkan was involved in securing an 11 billion riyal ($3 billion) loan from the Ministry of Finance in April. He has also met with creditors, primarily local banks, to offer reassurances about the group’s future. Harkan told those present that the company was a “mess and hopelessly insolvent,” but that he had been appointed by King Salman to lead its turnaround, said one attendee. To the incredulity of some of those listening, Harkan also explained the brothers were “relieved to be absolved of their responsibilities.”

Despite those assurances, the company’s future remains uncertain. As Harkan has told creditors, plans drawn up after Froehlich was hired will be dusted off. The estimated 537 companies that make up the conglomerate, from construction to energy, will be broken up and the name of the company changed to distance it from the Bin Laden legacy.

Also at issue is money owed to Saudi Binladin Group. After the Ritz detentions, what one source described as an “army of accountants” began combing through the company’s books, trying to make sense of the government’s liabilities to the firm. A person close to the family gauged it at nearly $40 billion. A company director estimated the amount was smaller. The senior government official said the government had no liabilities to the firm, but there were “some disputed payments among several government agencies that are being addressed.”

LIFE AFTER THE BIN LADENS

Saudi Binladin Group has 93 projects in hand and ties to 1,400 subcontractors, but most of its work is on hold. The company is focusing its efforts on delivering one massive project, commissioned by Prince Mohammed. The project is NEOM, a $500 billion business zone on the Red Sea coast that is the centrepiece of Mohammed’s vision for a modern, dynamic Saudi Arabia. The city will have its own legal system designed to attract international investors in high tech industries such as biotechnology, advanced manufacturing and tourism.

But the first buildings commissioned at the site were more traditional – opulent seaside palaces. These included a replica of the palace that Saudi Binladin Group completed for King Salman in Tangier, Morocco, said three sources, one of them working at the site. According to a project design document reviewed by Reuters, the site has palaces for the king, Prince Mohammed and his brother Prince Turki, as well as smaller villas for other royal brothers and “family princes.” Landscaped with fountains and flowering trees, the complex will also feature three helipads, a marina and a golf course.

Contracts for the palaces originally went to other Saudi construction firms. But according to the source at the project site and two other sources, those companies were unable to handle the scale and speed of the project.

Tens of thousands of Binladin workers were diverted from other projects around the country. They worked 24/7 at breakneck pace to deliver, toiling through the sweltering summer months, said three sources. Grass planted outside the palaces did not grow quickly enough for the Aug. 1 deadline, so the workers had to replace it with artificial turf before the royal arrival. The senior government official confirmed that a subsidiary of Saudi Binladin Group was involved in the building work.

Prince Mohammed took regular flights around the project to survey its progress, according to four people familiar with the matter. Two of them said he has taken charge of marketing NEOM himself, bringing in prospective investors for official tours and alcohol-free parties. At the end of July, he and the king moved to the unfinished complex for their summer holiday. With no other structures on site, trailing cabinet members and business leaders stayed on yachts or in the nearby town of Sharma.

Once again, the kingdom needed the knowhow of Saudi Binladin Group.

ROYAL VISION: Saudi Arabia’s NEOM business zone will have its own legal system designed to attract international investors in high tech industries. Above, plans for NEOM are presented in 3D at an exhibition in Riyadh in 2017. REUTERS/Faisal Al Nasser

ROYAL VISION: Saudi Arabia’s NEOM business zone will have its own legal system designed to attract international investors in high tech industries. Above, plans for NEOM are presented in 3D at an exhibition in Riyadh in 2017. REUTERS/Faisal Al Nasser

Princely ambition

By Katie Paul, Tom Arnold, Marwa Rashad and Stephen Kalin

Photo editing: Simon Newman

Design: Catherine Tai

Edited by Janet McBride and Richard Woods

REUTERS Investigates: As a Saudi prince rose, the Bin Laden business empire crumbled

COMMENTS